- Portfolio News

- 15 July, 2024

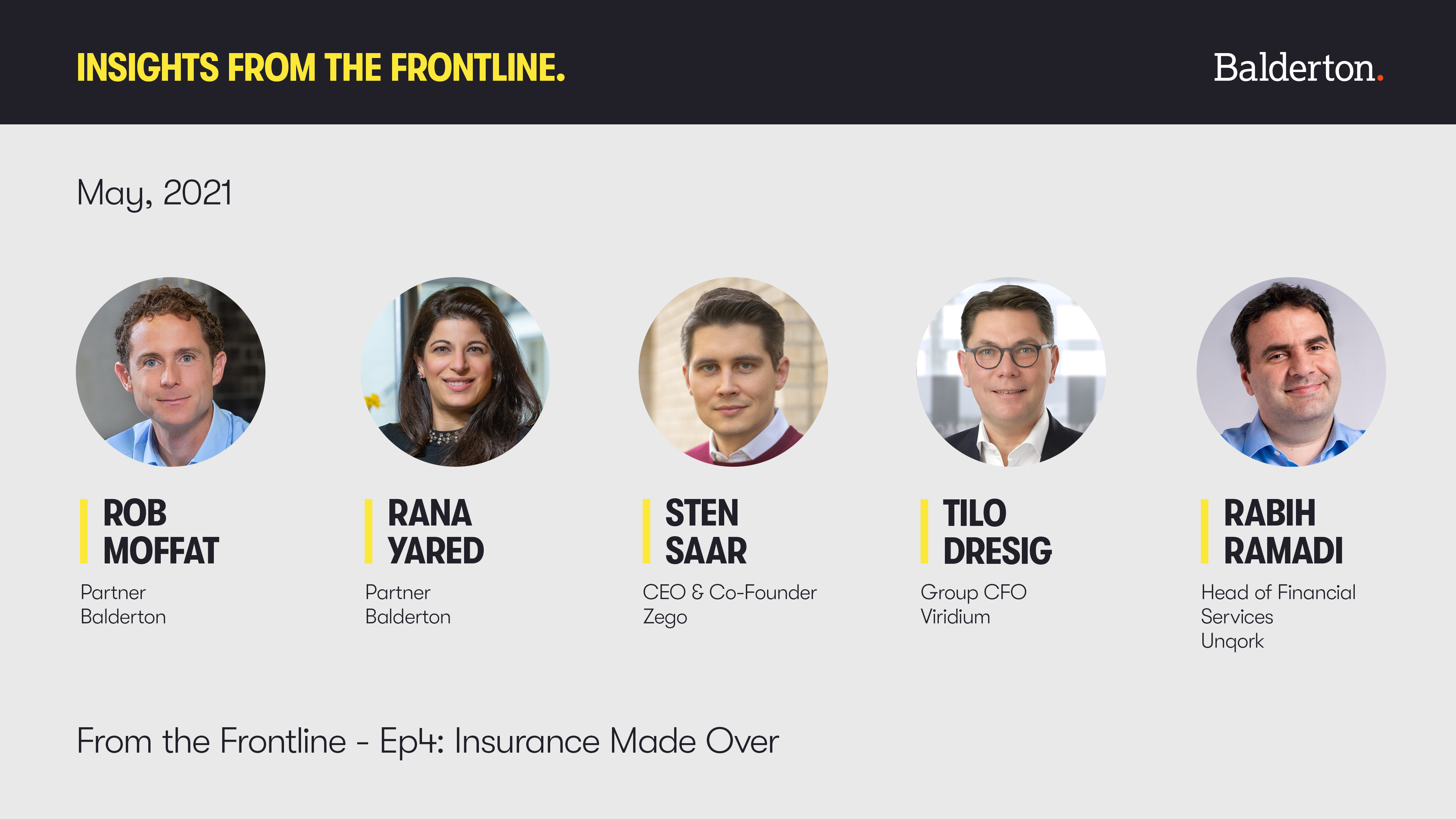

Last week it was our pleasure to welcome three thought leaders from the frontline of the insurance industry to discuss the reshaping of the industry.

Since the financial crisis of 2008, nearly every segment of financial services has been transformed by technology. The notable laggard was insurance where complex capital rules, coupled with long term risk management needs, created significant barriers to entry.But that has started to change, with companies improving the customer experience by turning to a digital first experience to those transforming workflows and massively increasing efficiency through the use of low-code solutions and automated portfolio management.Sten Saar – Founder & CEO of Zego

Zego is the leading global innovator in commercial motor insurance, using technology to make insurance fairer and more efficient. Balderton led Zego’s Series A in 2017. They recently raised Series C at a $1.1B valuation led by DST and General CatalystRabih Ramadi – Head of Financial Services and Insurance at Unqork

Unqork is the leading no code platform for insurers. Rana led their Series A at her prior firm Goldman Sachs. They recently raised Series C at a $1.35B valuation led by BlackrockDr Tilo Dresig – Group CFO and incoming CEO of Viridium Group

Viridum are the leading closed life insurance consolidator in Germany and one of the leading companies globally.

Replay the video of the event here:

Challenges and opportunities in the insurance market

We first discussed the biggest challenges and opportunities that each of the panelists observed in the insurance market.For Sten, this was around the rapidly changing nature of mobility and delivery, and internally how Zego scale a remote team effectively at rapid speed.For Tilo and Rabih, the biggest challenge they see is the legacy software used by incumbent insurers. Often, it can be easier to start again from scratch rather than try to continue patching together and improving existing systems.This is the exciting opportunity: to use breakthrough technologies such as Unqork to speed up product velocity and reduce costs.Sten’s analogy was an ‘artificial christmas tree’ where the insurer has a strong and modern core system which other parts of the software stack can branch off.The next topic was the importance for companies writing insurance business to own their own balance sheet, and the trend for consolidation shown by companies such as Viridium.A challenge for insurers is the limited number of client interactions they have and so it is vital that in those interactions they are delighting their customers. Controlling the claims experience is an important part of this. Equally important is the ability to rapidly launch and refine insurance products (days not months), enabled by a modern software stack and by having your own capacity.Finally, we discussed valuations of some of the recent insurtech IPOs: Root at $2.5B, Lemonade at $4.5B, Hippo and Metromile SPACs. Fair to see that there were different views on this between the panelists, but a consensus that valuations relate to the size of opportunity in a trillion dollar insurance market more than being anchored to a revenue multiple.Many thanks to Rabih, Tilo and Sten for a great discussion!