- Portfolio News

- 15 July, 2024

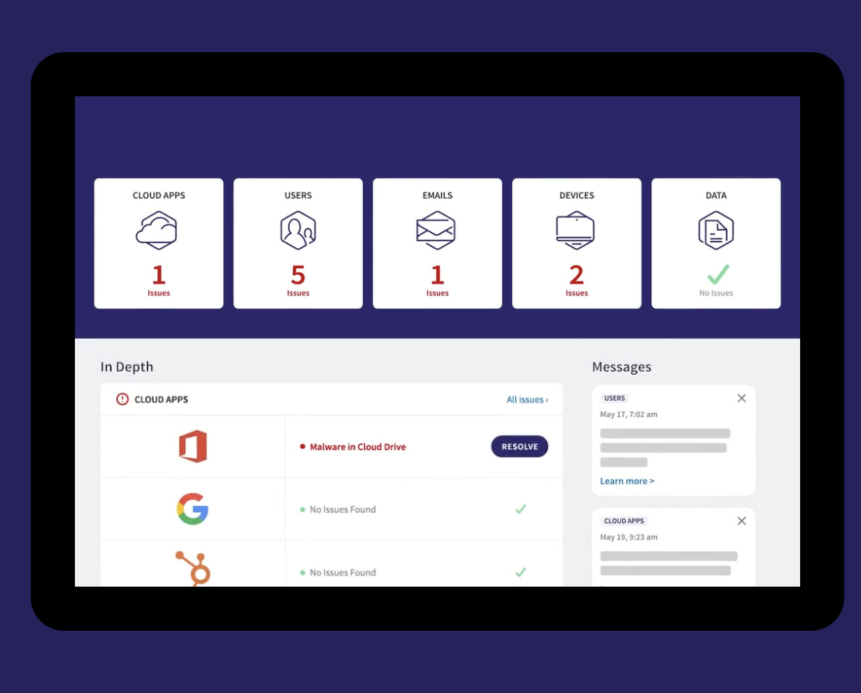

Coro, the modern cybersecurity platform for mid-market organizations, today announced a $75M funding round, bringing the total funding raised in the last 12 months to $155M. Coro added Energy Impact Partners to its current investors, JVP and Balderton Capital – who led Coro’s Series C last year. Coro continues to experience dramatic growth across all aspects of its business. The company’s modern approach to cybersecurity – delivering enterprise grade security through a single platform that unifies, simplifies and automates workloads – has been validated by more than 5000 mid-market customers across every vertical industry.Over the past year, Coro tripled its revenue, customer and employee base, and signed more than 100 new channel partners. The company also expanded its footprint in Chicago, where a new business enablement center is under development to support the company’s direct sales team and rapidly growing network of resellers. Coro projects it will again grow 300% year-over-year in 2023, extending its extraordinary record to a 5th year in a row.Coro will use the new funding to support its rapidly growing customer base and drive aggressive growth across its R&D, channel, sales and service teams. The new capital will also enable Coro to continue to expand the capabilities of its cybersecurity platform, both organically and through strategic acquisitions.