- Portfolio News

- 15 July, 2024

Wagestream raises £20M Series B to help more employees access their earned wages in real time

The new round, led by Northzone, takes the total raised to £65m and will be used to consolidate the company’s dominant market share in the UK and to fund its international expansion.

Balderton previously co-led Wagestream’s Series A in May 2019. You can read Rob Moffat’s Medium post here explaining why we invested. Wagestream enables staff to draw down a percentage of their earned wages any day of the month for a flat £1.75 fee, offering them greater flexibility with their finances. As there are no loans involved, no interest is charged. Having access to earnings also means many forms of high-interest credit are easier to avoid.Wagestream has seen demand for its product skyrocket among major UK brands over the past year. New client sign-ups were particularly strong in the second quarter, as employers sought to make their staff more financially resilient in the face of Covid-19.

Where people work and how they work is changing by the day, all the more so since Covid-19 struck. Now the way in which people get paid is changing, too, and at scale. Wagestream provides a financial flexibility that is perfectly suited to today’s agile and progressive workforce.

Peter Briffett, CEO and Co-Founder, Wagestream

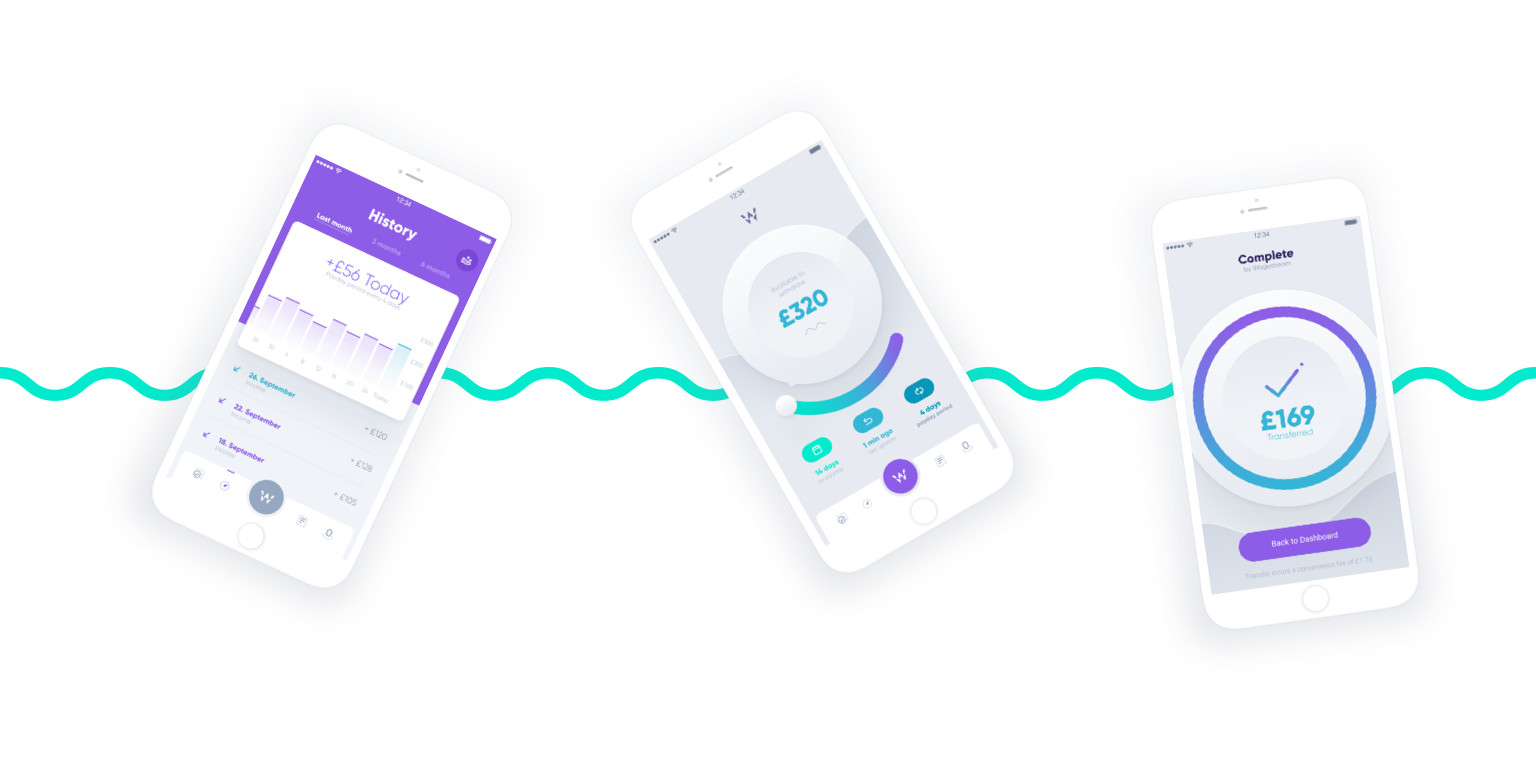

Wagestream’s Income Streaming Product

Major UK employees have signed up for Wagestream including five NHS Trusts, Bupa, Rentokil, Honest Burgers, Fuller’s, Brewdog, Zizzi and Roadchef. Wagestrean clients have identified a number of CSR and HR advantages to the service. For example, employees have greater financial flexibility and security, which increases staff loyalty. The company’s research showed that 77% of users felt less stressed, 38% had avoided going into their overdraft and 43% said they’d avoided using a payday loan.

Each day, too many staff in too many companies are being forced into the hands of predatory payday lenders because they are only paid their earnings once every 30 days, enabling people to access their earned wages anytime keeps them out of debt and also incentivises them to do more shifts because they are motivated by the ability to use that extra income immediately to make specific purchases.

Peter Briffett, CEO and Co-Founder, Wagestream

Peter Briffett, CEO and Co-Founder, Wagestream at Balderton’s People Summit in 2019

Wagestream has gone from strength to strength over the past year. The feedback from employers and employees alike is positive across the board and the number of companies adopting this way of paying their staff has now passed that all-important tipping point. Wagestream is going mainstream and we are excited to play a part in its growth story!

Rob Moffat, Partner, Balderton

Read Rob’s post: “£50B, or why Balderton Invested In Wagestream.”