- Portfolio News

- 15 July, 2024

Portfolio

Revolut at seed – a revolution in the making

FEB 25, 2020

Revolut has raised $500 million, led by TCV, valuing the business at $5.5 billion, making it one of the highest valued fintech companies in the world.

Daniel Waterhouse and Revolut CEO Nik Storonsky at Balderton’s Talent Summit in 2019

You say you want a revolution

Well, you know

We all want to change the worldSongwriters: John Lennon/Paul McCartney

It’s not every day a company closes a $500m round at an exceptional valuation. Congratulations to the whole Revolut team of 2,000+ on this incredible milestone. This is a far cry from the $2.3m “late seed/early A” round we led 5 years ago.While big numbers are impressive and this capital gives Revolut the ability to scale to the next level, I think what is more interesting is why and how Revolut was able to conclude this sort of financing round.Before getting to that I looked back at our original investment memo from February 2015 (and this was essentially the crux of the investment thesis):

“It speaks for itself: a multi-currency credit card & app that works as a local debit card in each country and cuts out all the foreign currency fees and Forex spreads.

This is a very early stage deal – the app only launches this week.

But the guys are really smart and we believe this is a unique and incredibly compelling/disruptive customer proposition in an otherwise commoditised space.”

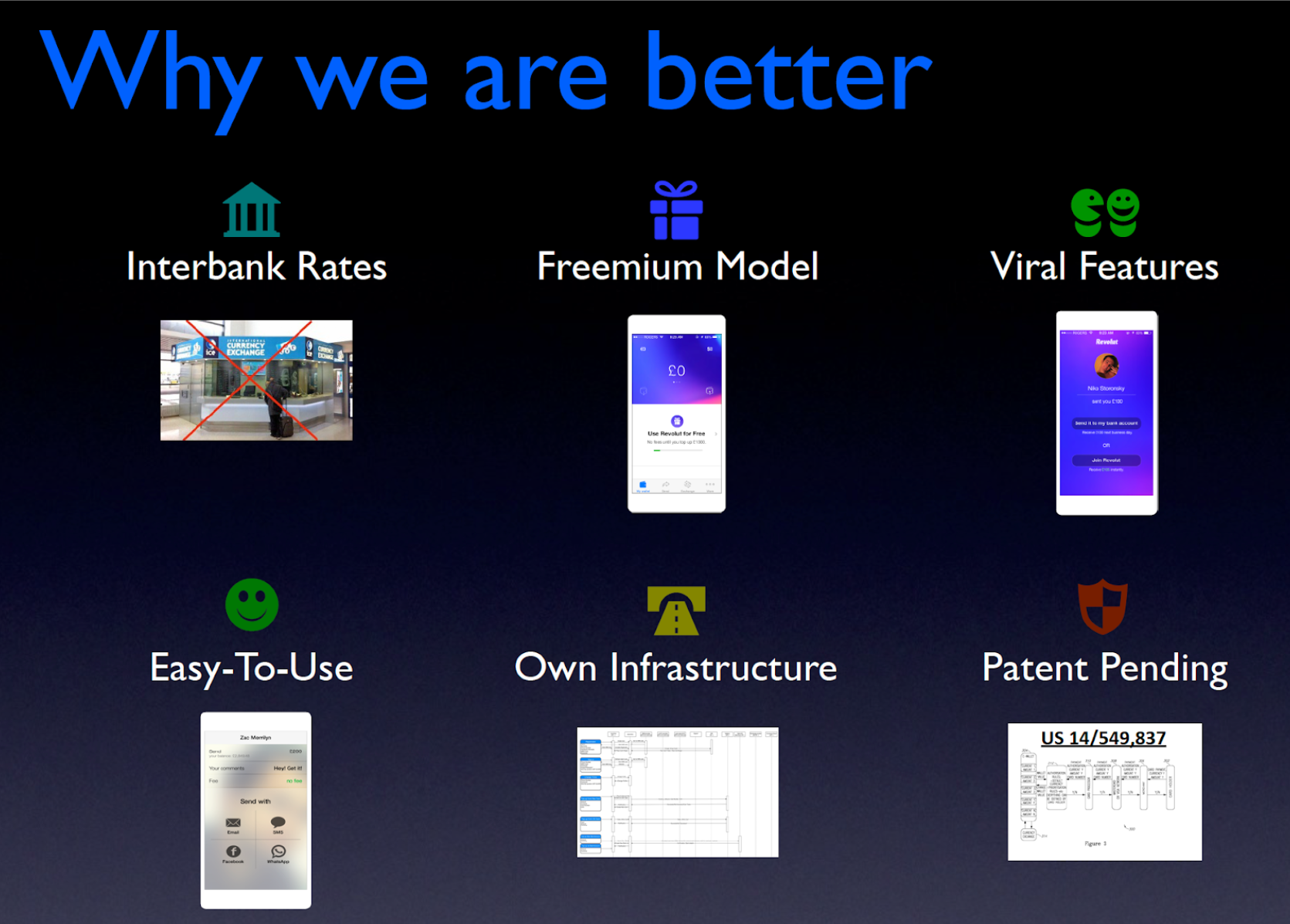

Revolut investor deck – Feb 2015

This was the nub of our decision to lead Revolut’s first institutional round which closed a couple of months later and then we went on to lead the subsequent Series A round and invest a further five times over the last five years.The guys being “really smart” was a bit of an understatement. The two founders, Nik and Vlad, were exceptionally smart, having excelled academically and professionally and came with deep FX domain expertise and technical know-how. They also had a high level of ambition and convinced us they could overcome any hurdles to succeed.

Revolut cofounders, Nik Storonsky and Vlad Yatsenko.

We had seen the team present at Seedcamp but really engaged when a good friend of the firm’s told us about his experience of spending time with the team.The initial product was focused but very compelling and acted as a differentiated way to bring people into the Revolut ecosystem. They offered customers the ability to exchange and spend currencies and pay in their local currency based on the spot interbank fx rate – this was ~5% cheaper than what most debit or credit cards would charge. Since then the team has built and launched a variety of additional products and services which their user base has adopted with great enthusiasm. These include Trading, Saving Vaults, Spend Analytics, Bill Splitting, a host of Premium Services and much more. They have also expanded out of the EEA and into several new markets including Australia, Singapore and North America.This has allowed Revolut to be one of the fastest ever growing fintech companies. In the last year alone they trebled their user base to over 10m consumer accounts. And these users are highly engaged and very profitable.

Nik with Balderton’s Managing Partner, Bernard Liautaud, at the Balderton CEO Collective 2018

One of Revolut’s values is “never settle”, and this is a core part of their success – no one is ever satisfied that the status quo is the best way to do things and they constantly look to make this work better and more efficiently, be that product release velocity, the hiring process or compliance and risk systems.It has not been plain sailing and like most fast-growing companies they have had some challenges. But, as they grew, they learned, and applied their special and unique data viewpoint to every part of the business, including management. They don’t guess. They analyze exhaustively. And so they now excel at what I call “programmatic management” – a robust OKR setup with cascading KPI objectives and real-time monitoring of every part of the business. This provides company-wide transparency to each employee on what the goals are, allows for quick course correction and smart decision making. One innovation that forms part of this is removing Business Debt — which is what they call problems created by a project or person for another part of the organisation, such as excessive support tickets resulting from a feature releaseOf course, as a regulated business, there is, quite correctly, a lot of focus on risk, compliance and the control functions. Revolut has been investing heavily in these areas and we are pleased to welcome several industry experts to the Board, including Chairman Martin Gilbert (founder of Aberdeen Asset Management) in November of 2019.We have been fortunate to be joined along the way by our friends at Index, DST, Ribbit, Point9, Lakestar and many others and welcome new investors TCV and Bond (and others) to the cap table.One of Balderton’s key beliefs is that the next European giant will be a technology company. Revolut is on its way to proving this.

Vive la Revolut(ion).

You can read more about the fundraise here. The story also appeared on Daniel’s Medium.