- Portfolio News

- 15 July, 2024

Premialab is an independent data and risk analytics platform used by institutional investors looking to monitor, manage and diversify their global portfolios

The company was co-founded by Pierre Trecourt and Adrien Geliot (formerly of Societe Generale, and Julius Baer respectively) in 2016, to bring transparency, intuitive data and risk analytics to one of the most complex areas of investment, through its Premialab Pure Factors® model. Premialab’s partnership with Balderton Capital will enable growth and the hiring of talent across Premialab’s business development, sales, and marketing teams to further accelerate its mission of bringing transparency and efficiency to the quant and multi-asset investment universe.Over the past 12 months, Premialab saw its staff double with new hires in its locations in Asia, Europe and the US. This included the hiring of John Macpherson, former Managing Director and global head of listed derivatives at Goldman Sachs, Nomura and Citibank, Andrew Baehr, former Managing Director at Credit Suisse, BNP Paribas and Morgan Stanley and of Dr. Vincent Zoonekind, formerly Deutsche Bank’s Head of Quantitative Research, as Premialab’s Head of Data Science in September 2020.

Our new office in London and our partnership with Balderton Capital sees us build further on the momentum of growth we’ve experienced over the past 12 months. It allows us to provide more effective support to our global client base while scaling our activity in key growth markets.

Adrien Geliot Co-founder, Premialab

Premialab was co-founded by Adrien Geliot and Pierre Trecourt

The need for Premialab

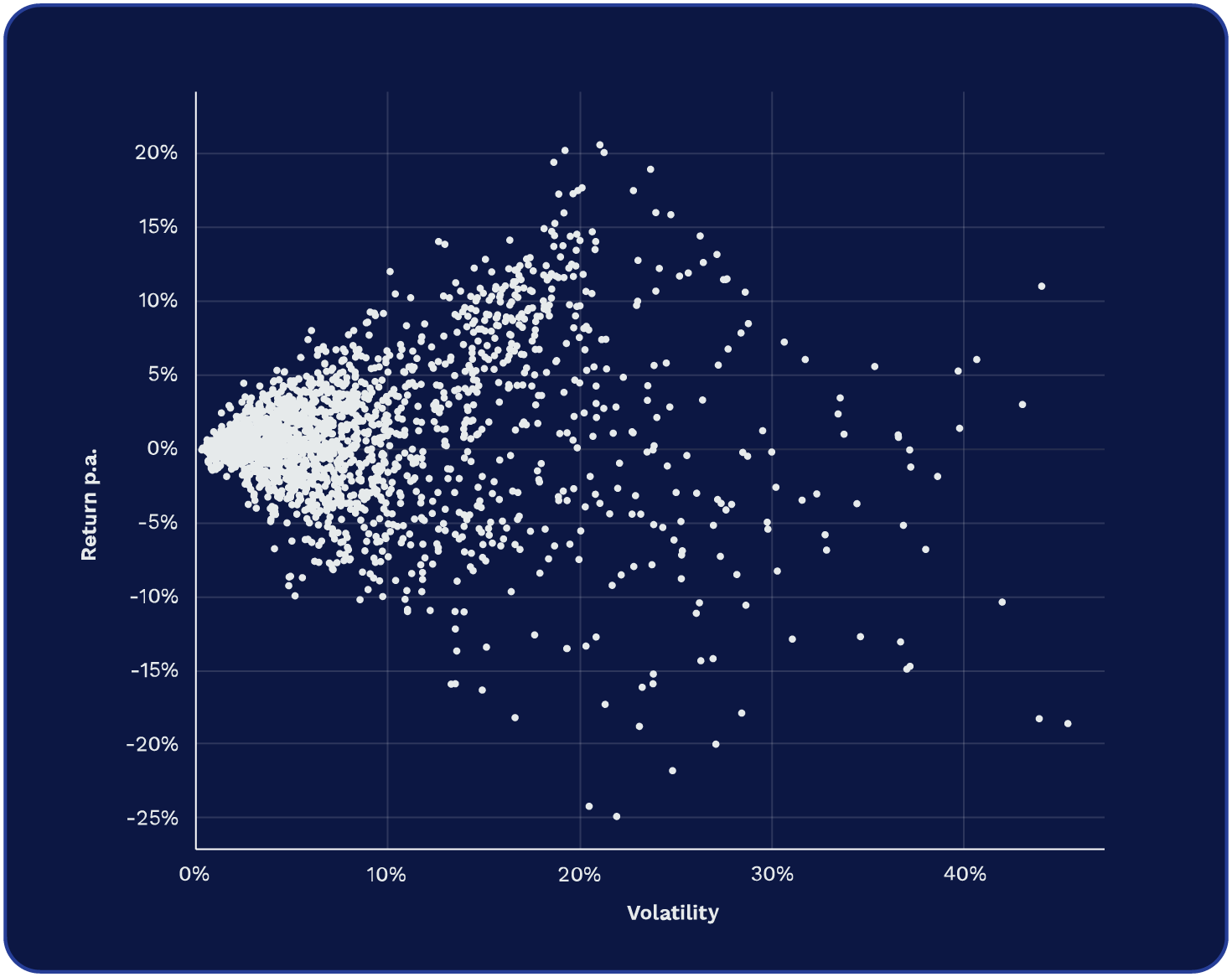

Premialab is a sophisticated investment intelligence platform that provides financial institutions with a competitive edge when allocating to multi-asset and quantitative strategies. Exclusive investment banking strategy data combined with advanced modelling and risk analytics provide a quantitative framework enhancing portfolio returns and risk monitoring.Asset allocators can use the platform and multi-asset factor lens to streamline peer comparison, strategy selection and due diligence, monitor style drift, build hedging overlays and enhance portfolio returns with full risk oversight into their allocations.Prior to Premialab’s launch, investors relied on individual data sets containing thousands of strategies and positions from banks, each formatted and presented in different ways. This made it difficult to compare and contrast strategies and risks. At the same time, decades of research and advances in technology have led to the rise of factor investing. Factor investing involves targeting specific drivers of return across asset classes to reduce volatility, create more diverse portfolios and improve outcomes. Yet, identifying which factors – from as many as 250 – are impacting a portfolio requires a vast data set alongside advanced AI and machine learning technology to present the analysis.Premialab’s platform consolidates thousands of investment bank strategies with millions of data points on risk factors, generated by its Pure Factors technology. It then presents this consolidated data in accessible and easy-to-use statistics, graphical analysis, and visualisation tools. From this, investors can see how different strategies are likely to perform; they can design and monitor their portfolio diversification; they can see and track risk factors across multiple asset classes, in multiple regions. In addition, they can stress test their portfolios with look-through on underlying constituents under multiple scenarios and market shocks.

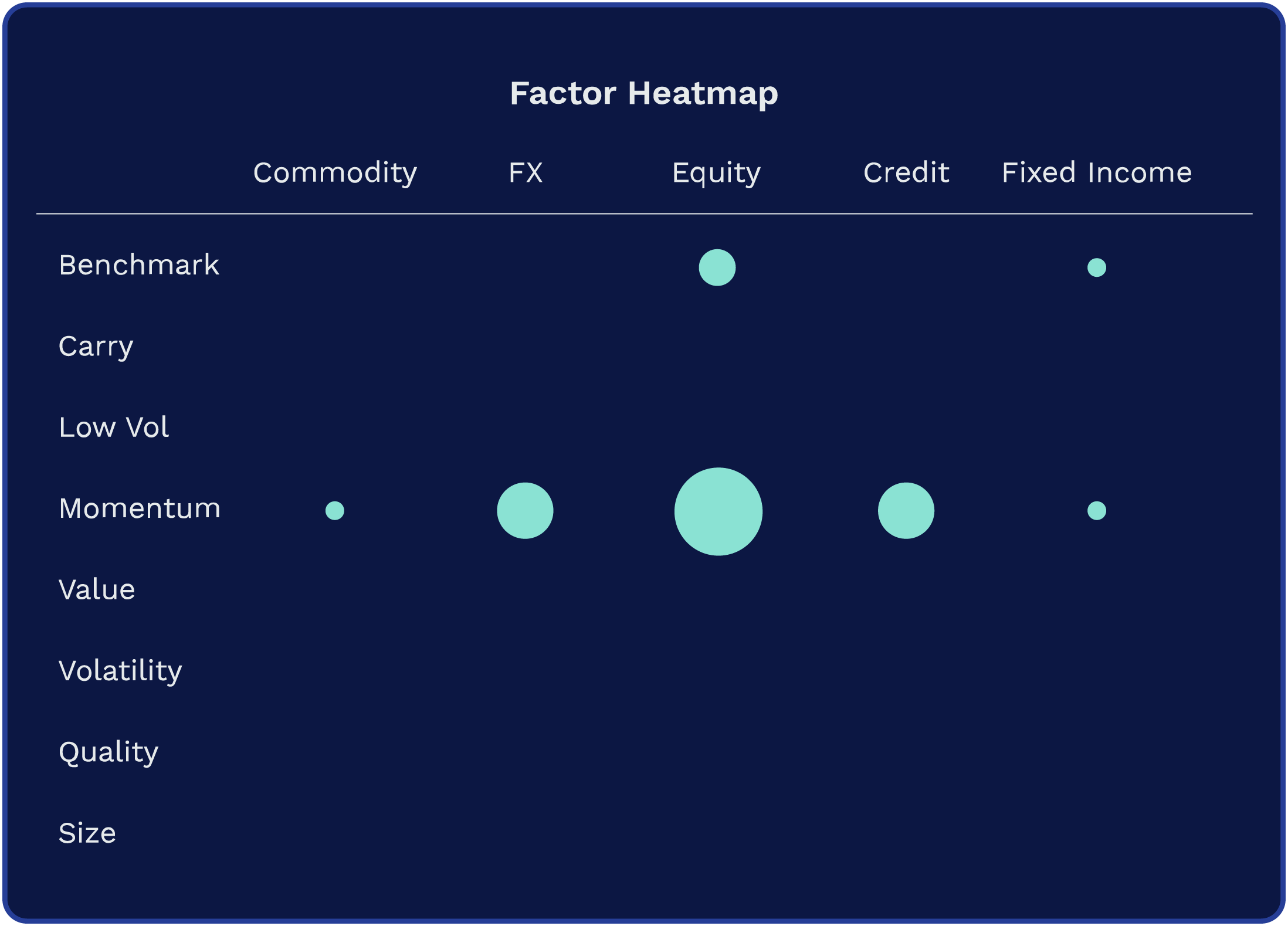

Heatmap of Factor Risk Proportion

How Premialab works

Premialab sources daily performance and exposure/position level data of proprietary systematic trading strategies from 17 large investment banks. This equates to 3,500+ strategies. It then uses this to build out an independent, customisable data and risk analytics platform powered by its performance engine.The partnership with Balderton Capital will enable growth and the hiring of talent across Premialab’s business development, product, and marketing teams to accelerate towards its mission of bringing transparency and efficiency to the quant and multi-asset investment universe.As strategy trading is a rules-based method, investors can apply different rules – or a combination of rules/strategies – to their portfolio to assess and evaluate the relative performance of each. The platform is built with a variety of filters and display options allowing customers to see and monitor the elements that matter most to them and their portfolios. This means they can easily access underlying positions presenting information on strategy components in a clear, concise presentation for compliance and regulatory risk reporting.

Portfolio Risk and Pure Factors

Within this platform, and building on its set of more than five million data points, Premialab then provides portfolio risk analysis via its Pure Factors technology. Premialab’s Pure Factors technology looks at the risk profile of different strategies and clusters strategies from the same risk factor together. It then extracts Pure Factors. Built on the assumptions that strategies from the same factor should have a similar risk profile, because they are exposed to the same set of market inefficiencies, Pure Factors can highlight the maximum variance that strategies within the same factors can operate and shift in.From this methodology and approach, Premialab has identified 47 Pure Factors against which strategies are analysed, across seven risk factors (Carry, Volatility, including Low Volatility, Momentum, Quality, Size, Value), five asset classes (Commodity, Credit, Equity, Fixed Income, Foreign Exchange) and four regions (Global, US, EU,EM).Clients use these Pure Factors to get an independent measure of risk, and better control their portfolio diversification. They can also use it for factor decomposition, where they use these Pure Factors to decompose any investment portfolio into independent risk factors.

Scatterplot of QIS Strategies

Systematic and factor-based investing is transforming the asset management industry. Premialab has pulled together a unique set of data on factor-based strategies from all the major investment banks. They have used this to create their proprietary Pure Factors which finally bring transparency on performance and risk to this sector. Their clients include some of the biggest and smartest names in asset, insurance, pensions and sovereign wealth.