- Portfolio News

- 15 July, 2024

Digital Surgery acquired by Medtronic – Three observations on their journey

FEB 14, 2020

Digital Surgery announced this week it has been acquired by the medical device leader, Medtronic.

As the first institutional investor in the company, with my then-partner Mark Evans leading their Series A back in 2013 and my working with the board since 2015, we’ve had the absolute pleasure of being able to work with Jean and Andre as they built their company from idea to full strategic fruition.Others have covered the strategic rationale behind the acquisition, so I wanted to focus on three observations we’ve made, here at Balderton, on what contributed to making Digital Surgery such a huge success in a complex market.

1) The Strategic Pivot

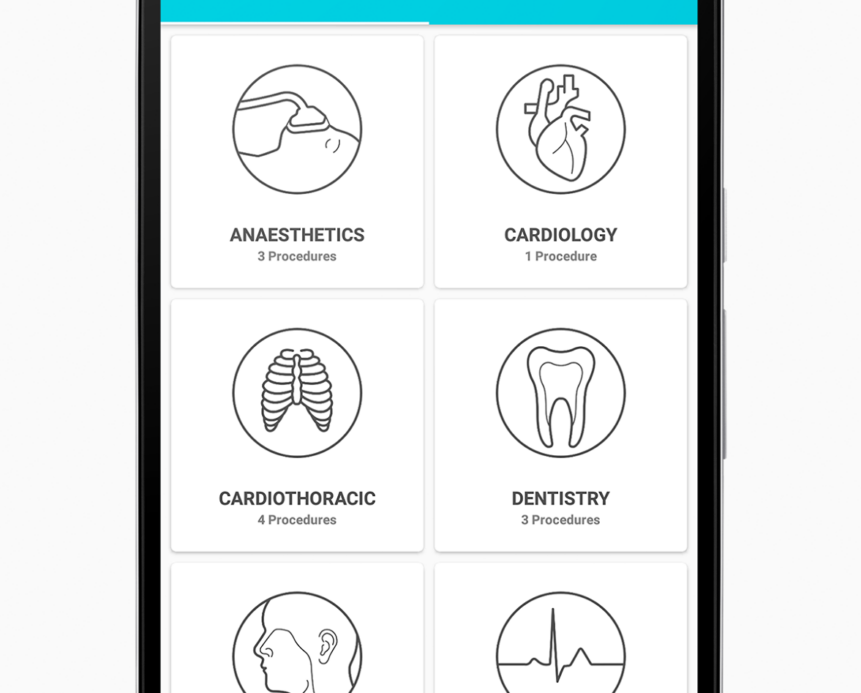

When Digital Surgery (then Touch Surgery) started out, they wanted to build a ‘flight simulator’ for surgeons. The focus was on education. As two fully-trained surgeons, founders Jean and Andre were well aware of the massive cost of training medical specialists, a lot of which is driven by the number of hours they are required to spend on physical practise. Keen to disrupt this and bring costs down, training levels up and thus further democratize surgery, the team built the world’s best 4D models of the human body and undertook in-depth peer-reviewed research demonstrating the effectiveness of purely digital training.While this product enjoyed market fit – it still has thousands of users – the commercialisation was hard. Education is a difficult sector with fragmented, limited budgets. The team thoughtfully pivoted – not by burning to the ground what they had built, but by identifying the highest value assets (the models and procedures they had captured through thousands of surgeons using the product) and re-focusing them on a new, more profitable problem: the virtualized operating room and, ultimately, surgical robotics. This new direction gained traction rapidly and is a big part of why companies like Medtronic got excited about the opportunity ahead.

2) Using the Board

Jean and Andre were also smart in deciding who to work with during each investment round, always selecting partners who would bring something new to the table. Once that new board member was settled in, they were relentless in getting as much value from them as possible. Ulf from AO gave the company access to the health organisations they needed, Damien from Episode 1 was on the ground in the early days, helping them set up the early team and structures; Alastair from Redline sat with the team and built out their financial plans in meticulous detail as the company pivoted its business model; Drew brought a wealth of contacts from 8VC‘s formidable network in US healthcare.

3) The Outsized Ambition

One of the pillars we run our firm on is the belief in entrepreneurs with outsized ambitions. This is Jean and Andre personified. Fully trained as surgeons, they could easily have pursued lucrative, establishment careers but they didn’t. They had a big idea, they dared to believe and did not give up for a moment in the seven years of building the company, regardless of the many twists and turns that came their way.Every company is different, every journey from foundation to exit unique, but I am a big believer in learning from what has worked before. From Digital Surgery, from Jean and Andre, I have learned: Smart teams know when to pivot and how to do it; successful companies look at their Board as a way to bring in the reputation, network and skills they need and, above all else, the strongest founders start with an expansive vision and possess the resolve needed to ride the inevitable bumps that will come along the way.Thanks again to Jean, Andre and the rest of the awesome team at Digital Surgery – we will miss you but, in equal measure, look forward to everything you will achieve with your new colleagues at Medtronic in the future.The press release from Medtronic can be found here. READ MORE ARTICLES