- Portfolio News

- 25 April, 2025

I am proud to share our latest and largest fundraise. Today, we are committing $1.3bn to Europe’s most ambitious founders through Balderton’s Early Stage Fund IX and Growth Fund II.

Reflecting on Europe’s tech journey

When I joined Balderton in 2008, the European tech ecosystem was still quite nascent, and there had not been many successes at scale. I’d spent the previous 18 years building Business Objects – going from $0 to $1.5bn in revenue, before selling to SAP in what was, back then, the third largest software acquisition of all time. I was eager for a new challenge and to re-invest my time and energy in the European tech ecosystem.

At the time, Balderton had just raised a fund of $480M and we were ready to go. The challenge, much to my surprise, was that we struggled to find companies that we wanted to invest in. In fact, it took us five years to deploy that fund. Back then, fewer people were starting businesses. Fewer still dared to think big and dream beyond the borders of their home country. And many of those that did have the vision and ambition to build global giants opted to do so from the US, where access to capital and the right support was easier.

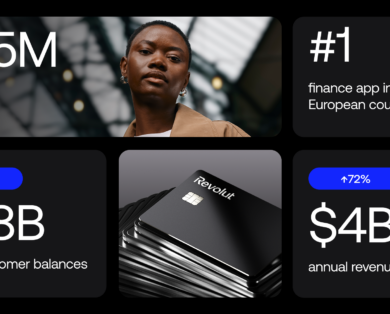

Today, the landscape is very different. Our ecosystem is thriving, with world-class talent and an established community of entrepreneurs, executives, advisors and directors who have significant startup and scale up experience. More people than ever are starting businesses – and those that do have global ambitions. They are determined to build companies like Spotify or Revolut instead of smaller regional leaders.

This story is reflected in the European VC investment numbers too: In 2008, venture investments in European startups were less than $8bn. In 2023, more than $50bn went into backing Europe’s tech entrepreneurs. And the returns speak for themselves, with European VC funds outperforming North American funds over both a 10 and 15 year period.

As we announce these new funds, I am filled with more optimism and confidence in Europe’s tech scene than ever before. A sentiment that is matched by our investors – an increasingly global mix of LPs who have strong confidence in Europe’s leading position on the global stage. They share our belief that the best way to change the world is to build a business, and have chosen, once again, to trust us in delivering on this vision.

Investing early in Europe’s best founders

The truth is, VCs don’t change the world. Founders do. And they work tirelessly, day in and day out, relentless in their determination to build something significant and to have a real impact on the world.

At Balderton, our mission is to be the partner of choice for Europe’s best entrepreneurs – identifying them early and helping them build global giants. We have been fortunate to find many of these pioneers at the very beginning of their journey – and to continue supporting them as they mature into global leaders in their fields.

Indeed, one thing that we pride ourselves on is the ability to build strong conviction early in the development of a new company. We don’t jump on trends or follow others just for the sake of it, we invest with a high degree of conviction. We build this through our experience working together as a partnership, our rigorous IC process, our experiences with portfolio companies and through our data and thesis driven approach. And we can continue to support our portfolio companies throughout their entire journey with our growth fund.

This includes trailblazers like Alex Kendall, who we first met in his Cambridge University dorm room, and whose outsized ambition and contrarian approach have led Wayve (Series A, 2019) to become the global leader in autonomous driving that it is today. Or Nik Storonsky, who we met when Revolut (Seed, 2015) was just a bold idea on a pitch deck. We’ve been at the team’s side at every step of the way to becoming the multi-billion dollar success story it is now, and we remain today the single largest institutional investor in the company. Or Simon Beckerman, whose unparalleled creative flair and all-consuming passion blew us away when he came to us for depop’s seed funding in 2012 – a company that has since completely transformed consumer fashion. The list goes on and on…

Thank you all for trusting us, and for the incredible ride so far.

A new era of innovation, supercharged by AI

As we close these new funds, we look ahead. Developments in artificial intelligence are propelling us forward into a new era of innovation and transformation, and Europe – with its world class institutions and engineers – has proven to be a clear leader in this next chapter.

We have already invested in many of the European leaders driving the new AI wave – like Writer, Wayve and Photoroom, among others. In Early Stage Fund VIII, AI-first companies made up a substantial portion of our investments, and the remaining companies are almost all investing in AI at some level as they continue to innovate and stay ahead of the competition. The pace of change in AI is unlike anything we’ve seen before, and while it’s impossible to predict exactly what the future will look like, it is clear that AI will change our lives in significant ways.

From fintech to health to climate – and equipped with the most powerful new technology we have seen in decades – the next generation of trailblazing entrepreneurs are already pushing innovation beyond its limits. They are building world-changing companies with more passion, drive and ambition than ever before.

With $1.3bn in fresh funds, 25 years of experience, and the same excitement and dedication as always, we can’t wait to see what this next chapter holds.

Here’s to the next generation of European founders, and to a remarkable journey ahead.

Bernard Liautaud

Bernard Liautaud