- 09 April, 2025

Measuring, reducing and offsetting our carbon emissions. What we have learned over the past year.

When we originally launched our 10 Sustainable Future Goals, one key action point was to review our internal carbon emissions measurement and offset methodology. Looking back, our initial approach was pretty much ‘finger in the air.’ After a few google searches and collecting too few data points from our finance team, we estimated that we had emitted 147.5 tonnes. We then partnered with Tree Nation to offset our impact by planting 2,100 trees in France. This year, we knew we had to do better! We’re sharing our learnings in this article, hoping to inspire some to follow suit and encourage others to share their own approach so that we can all benefit from knowledge sharing.

1. ASSIGN AN OWNER

Like most early-stage start-ups, we don’t have a Chief Sustainability Officer or someone whose role/expertise is to do this. This meant someone already in-house had to take this on. It ended up being people in our investment team since they had already looked at start-ups in the impact tracking space.We decided that the best way to do this was to involve an Analyst and a Partner. This meant someone had clear ownership of the initiative but was able to bring in the partnership where decisions were needed.

TIP:

Set a realistic timeline with deadlines to make sure the owner(s) can dedicate enough time to the project, especially if it’s not their full-time job.

2. PICK A MEASUREMENT TOOL

Since we became a member of Leaders for Climate Action (LCFA) this year, we were able to use their free tool to measure our Scope 1 and 2 emissions, which originate from our direct impact (eg. business travel, the office, energy consumption). Their calculator is flexible and comprehensive. It’s easy to understand for someone without an ESG background and nudges you into adding more granular data whilst offering estimates when the data was not readily available. There are many other providers that can be used (Sweep, Altruistiq, Planetly, Vaayu, Greenly among others as well as free ones like CarbonFootprint, CarbonTrust).In the long term, we will probably look to use a tool that helps us measure our Scope 3 / portfolio emissions. We hope to be able to monitor and track the progress of our portfolio companies across the 10 SFGs, with the aim of bringing those data points into board discussions and into our annual SFG Report.

TIP:

If you don’t have the expertise in-house, we recommend using a third-party tool. It will save you time and ensure a better level of accuracy.

3. COLLECT DATA

This process usually involves aggregating data across the business – from the office managers to the finance team.This year, we added granularity to some data points (e.g. by taking into account travel class) and we also added completely new data points (e.g. cloud storage cost and provider).

TIP:

This process can be slow if employees aren’t aware of the importance of the initiative. At Balderton, we ensured we had been communicating extensively about our SFGs internally, ensuring top-down buy-in as well as bottom-up involvement.

4. ADD CONTEXT TO THE RESULTS

Overall, we calculated that we emitted 121.6 tonnes of CO2 in 2020, 61% in energy and 38% in mobility.Although it includes more emission factors than last year, our emissions are slightly lower than in 2019. This is obviously due to Covid-19 significantly limiting travelling.

TIP:

Adding granularity to your measurement is key to increasing your understanding of the levers that can reduce emissions.

5. DECIDE WHERE TO REDUCE EMISSIONS

This is obviously one of the most important steps here and it can be daunting.There are two things you can do to prioritise and focus. First, identify low hanging fruits. Examples of that at Balderton include moving to green energy and reviewing our office recycling arrangements. Second, identify the areas of the business that have the highest impact. This follows the 80/20 rule where 80% of emissions usually comes from 20% of activities. It’s important to also take into account key stakeholders here (employees, customers, investors) in order to find solutions that align with their interests. At Balderton, a lot of our emissions come from travelling and so we have been reviewing our travel policy whilst being conscious of our own stakeholder needs (founders, LPs).

TIP:

Focus on the low hanging fruits and the areas of your business that have the largest impact. Follow the 80/20 rule.

6. TRACK YOUR PROGRESS

Balderton will be sharing an extensive update on the SFG actions later this year in the form of a report.Beyond picking the right metrics to track, it’s important to mention here that “good” is a great start. Lowering your expectations and seeing this process as a journey makes it easier. If the metric is not being collected today then start collecting it. The following year, you can set a target for reduction. We believe it’s ok to take things one step at a time, as long as you are constantly moving forwards!Prioritise short-term achievable goals, long-term goals should be broken down into smaller steps. Assign deadlines and responsibilities clearly to push change forward.

TIP:

Give yourself key objectives and deadlines to monitor progress and push change internally. For a year-on-year comparison, you can use tonnes of CO2/employee to separate company growth from impact.

7. DECIDE HOW MUCH TO OFFSET

Since 2020 was impacted by Covid-19, we decided to offset what we had estimated to have emitted in 2019 (147.5 tonnes).We believe it’s likely we underestimated our company carbon emissions, as we only included our direct impact (Scope 1 and 2), leaving out our impact through our portfolio (Scope 3). For this reason, we decided to also offset our employees’ individual carbon emissions (based on the average emitted per individual in the UK). This took our total to 657.5 tonnes.

We added employees’ individual carbon emissions, which represented nearly 4 times our company emissions.

8. DESIGN YOUR OFFSET PORTFOLIO

There are different types of offsets and each has its upsides and downsides. There are direct offsets that lead to direct carbon removal but they vary in durability, referring to how long the CO2 is kept away from the atmosphere. Some are short-term (<100 years) like nature-based solutions such as planting trees or soil sequestration and others are long-term (100 years+) like technology-based solutions such as enhanced weathering or direct air capture. Then you can also choose to use indirect carbon offsets which are participating in carbon reduction indirectly by either increasing supply of renewable energy or by increasing prices of carbon allowances for instance.What became clear to us is that no offset solution is perfect, which is why building a portfolio makes sense. We decided to allocate 50% to indirect offsets and 50% to direct offsets (see below infographic). Within direct offsets, we decided to add more weight to long-term carbon capture as it leads to longer-term sequestration despite higher prices.The resulting allocation is summarised below:

| Offset options | Example | Offset allocation |

| Direct short-term | Nature-based | 18% |

| Direct long-term | Biochar | 32% |

| Indirect | Renewables, KRBN | 50% |

TIP:

It is best to diversify via a portfolio of offsets instead of using a single method or provider.

We had to accept no offset solution is perfect.

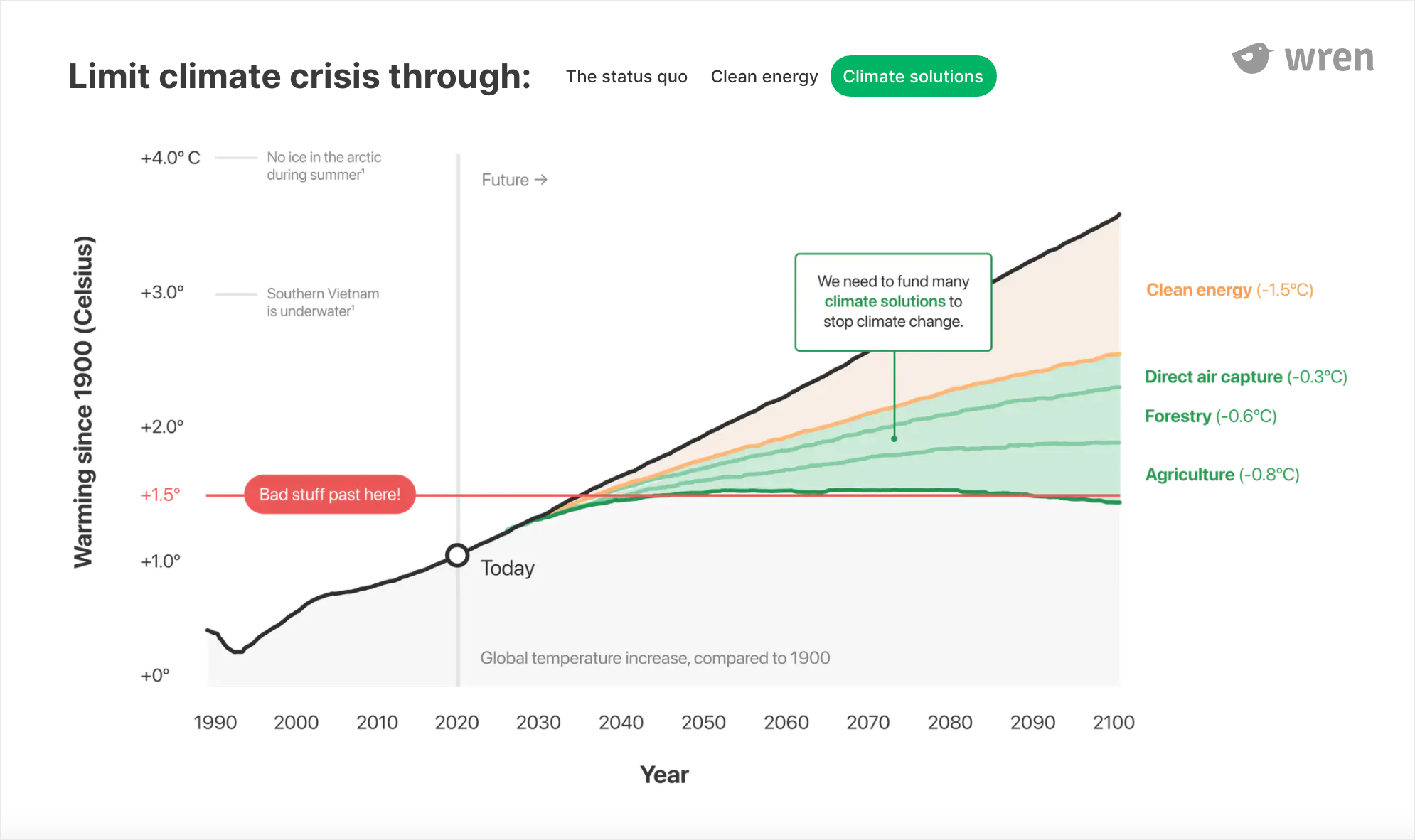

Historical emissions and predictions via En-ROADS. 1 2 Predicted events via Special Report: Global Warming of 1.5°C (IPCC 2018).

9. PICK YOUR OFFSET PROVIDERS

We spoke to ~15 European offset providers and we used the following characteristics to evaluate them:

- Measurable: Is there a robust approach to tracking and reporting the offset?

- Timing: Are the credits issued before (ex-ante) or issued after the CO2 capture? What is the buffer in the ex-ante case if the CO2 capture was overestimated by the project owner? What happens in that situation?

- Commission: How much are the provider and intermediaries charging?

- Uniqueness: Is the carbon credit issued by a key organisation (eg. Gold Standard)? How can the organisation ensure that the offset can only be retrieved once?

Price varies across offset projects, from a few euros to a few hundreds of euros per tonne of CO2. It’s based on project location (e.g. a reforestation project in Europe will cost more than in Central America) and cost (eg. soil sequestration projects are the most expensive offsets).At the end of the process, this is what our final 2020 offset portfolio looks like:

| Offset options | Offset Allocation | Tonnes in 2020 | Project chosen | Cost per tonne (€) |

| Direct | 16% | 105 | France, forest | 28.4 |

| Direct | 30% | 197 | Germany, biochar | 115 |

| Indirect | 18% | 118 | France, data farm, and Poland, wind farm | 7.2 |

| Indirect | 18% | 118 | TBC | 21.6 |

| Indirect | 18% | 118 | Carbon allowances | 29 |

That’s it for now. We’ll be publishing more updates as we continue on this journey!

Aim for the commission to be as small as possible whilst recognising that certifying and monitoring offsets have a cost.