- 24 July, 2024

Today’s macro environment is challenging, with high inflation and rising interest rates creating economic uncertainty. While the long-term technology opportunity remains strong, the private tech industry is experiencing a ‘hangover’ from the past few years – which saw a large influx of capital, high valuations and a focus on growth at all costs. Navigating this new environment raises many questions for founders and operators. To try and address some of the key challenges, we hosted a workshop for founders and teams planning for the year ahead. Here, we share a few of the key learnings from the discussion.

Download the slides here by David Thevenon, Partner and Dave Kellogg, EIR at Balderton Capital

1. What assumptions should we make about the future financing environment?

With capital more scarce and expensive, fewer early growth deals are being done.

Why?

- On one hand, investors have set a higher bar. Investors need strong conviction in both growth and efficiency, instead of just growth.

- On the other hand, many companies that raised at high valuations in the past 12-18 months are still trying to grow into those valuations.

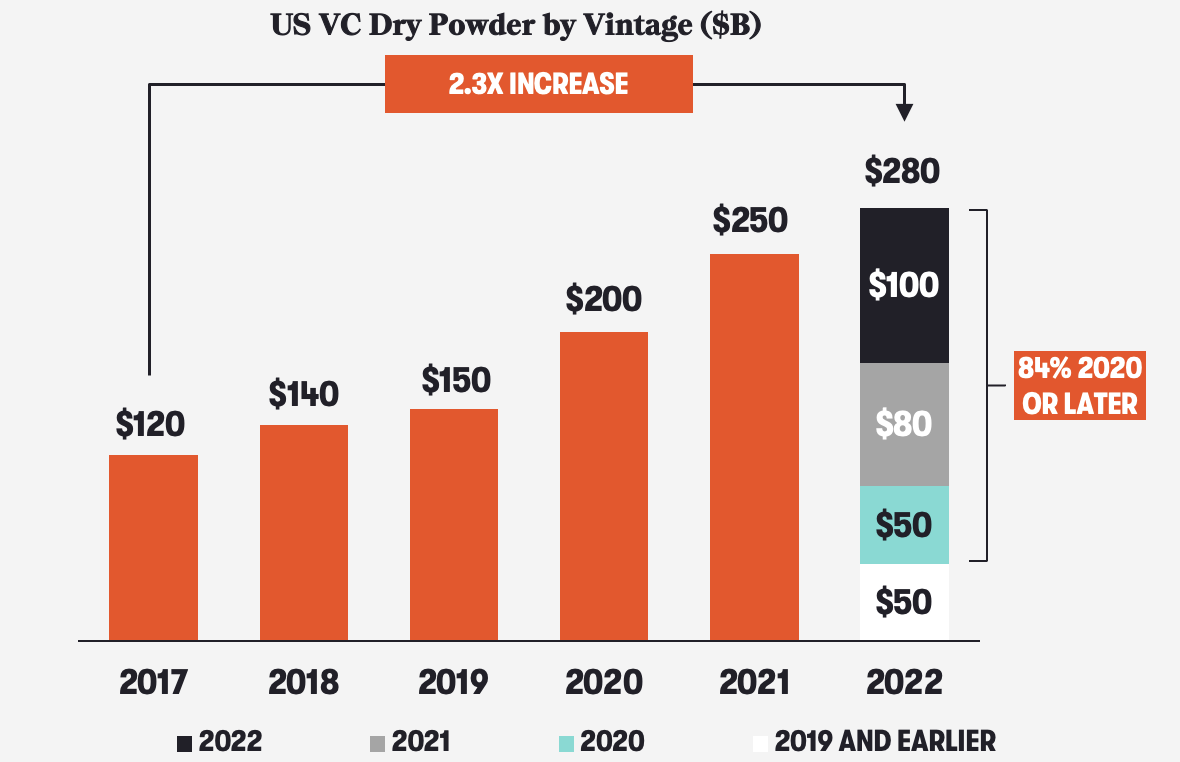

Isn’t there a record level of VC dry powder?

- Yes, there’s a good amount of capital available for founders from both new and existing investors. A lot of money has been raised by VCs over the last couple of years.

- The last few quarters have been slow for new investments, but investors are still trying to maintain their deployment schedules into new investments.

- Investors also will have to use some of those funds to support existing portfolio companies. Check with your current investors how much they have earmarked for your company.

How can I stand out?

- Investors are not expecting you to be profitable, but they are expecting you to have a very clear understanding of what levers to pull to get to profitability, and a clear plan to grow your company efficiently.

- Understand how your company tracks on key metrics vs. similar companies. Investors will prioritise companies that display top-quartile KPIs.

SaaS benchmarks top quartile by ARR range

| YOY Growth | NRR (ENT/ SMB) | Magic Number | CAC Payback | |

| $10-20M | 138% | 125% / 115% | 0.95x | 10 months |

| $20-50M | 114% | 125% / 115% | 1.1x | 11 months |

| $50-100 | 79% | 125% / 115% | 1.1x | 14 months |

2. What are the options to extend your cash runway through financing?

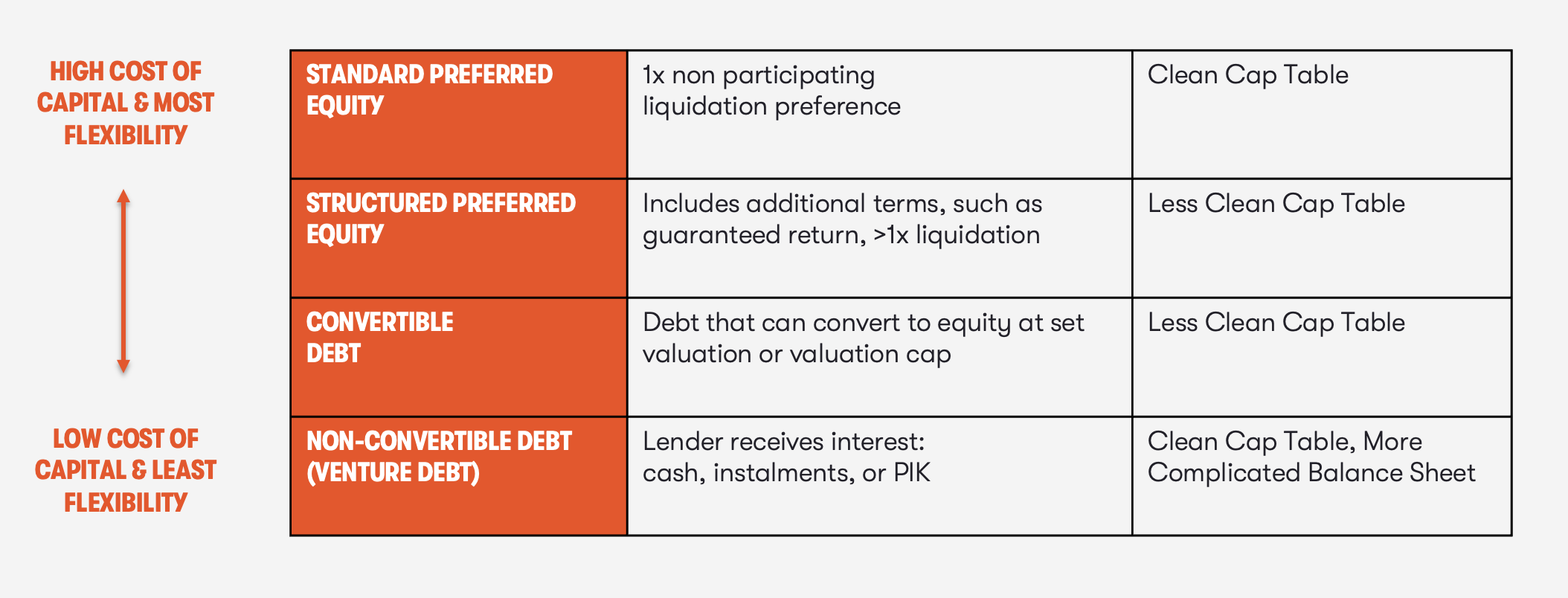

Capital has become more expensive. Therefore, founders will need to understand the best financing option(s) for their company. There are four main options: standard preferred equity, structured preferred equity, convertible debt, and non-convertible debt.

What should I do?

- Standard preferred equity is the most common equity structure for VCs – often paired to a 1x non participating liquidation preference, it ensures a clean cap table.

- However, in today’s environment, standard preferred equity may not be available or could result in a down round if your growth has not outpaced the market decrease in multiples.

What if that’s not available or I don’t want to take a down round?

- Investors can add structure to increase the headline valuation. However, this comes at a cost as warrants and other instruments also increase investors’ guaranteed minimum return.

- Familiarise yourself with structure terms in advance (warrants, liquidation preference, etc).

- If you receive an offer with structure, ask the investor for two term sheets – one with structure, one without, so you can compare the impact on valuation.

What about convertible debt?

- Convertible debt is also an option but leads to a less clean cap table.

- One way to think about this option is as a bridge to a further stage of development, and our advice is to clearly define that further stage from the outset.

Is venture debt something I should consider?

- Venture debt availability depends on the health of the company, and the terms have changed a lot in the past 12 months given the macro environment.

- The key thing to remember here is that ultimately it will need to be paid back, so your plan and unit economics need to be able to support this.

3. How can you extend your cash runway through operations?

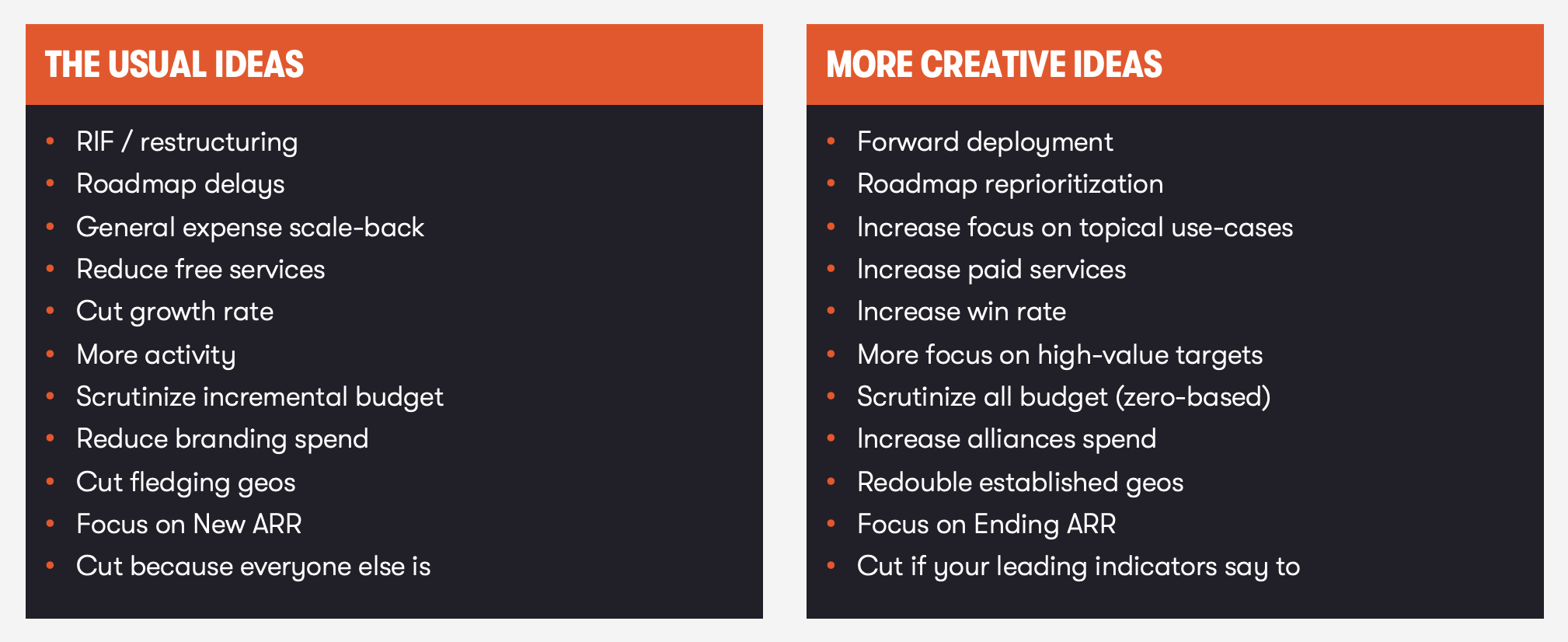

There are many areas to look at when extending your cash runway through operations, many of which are outlined in the slide below.

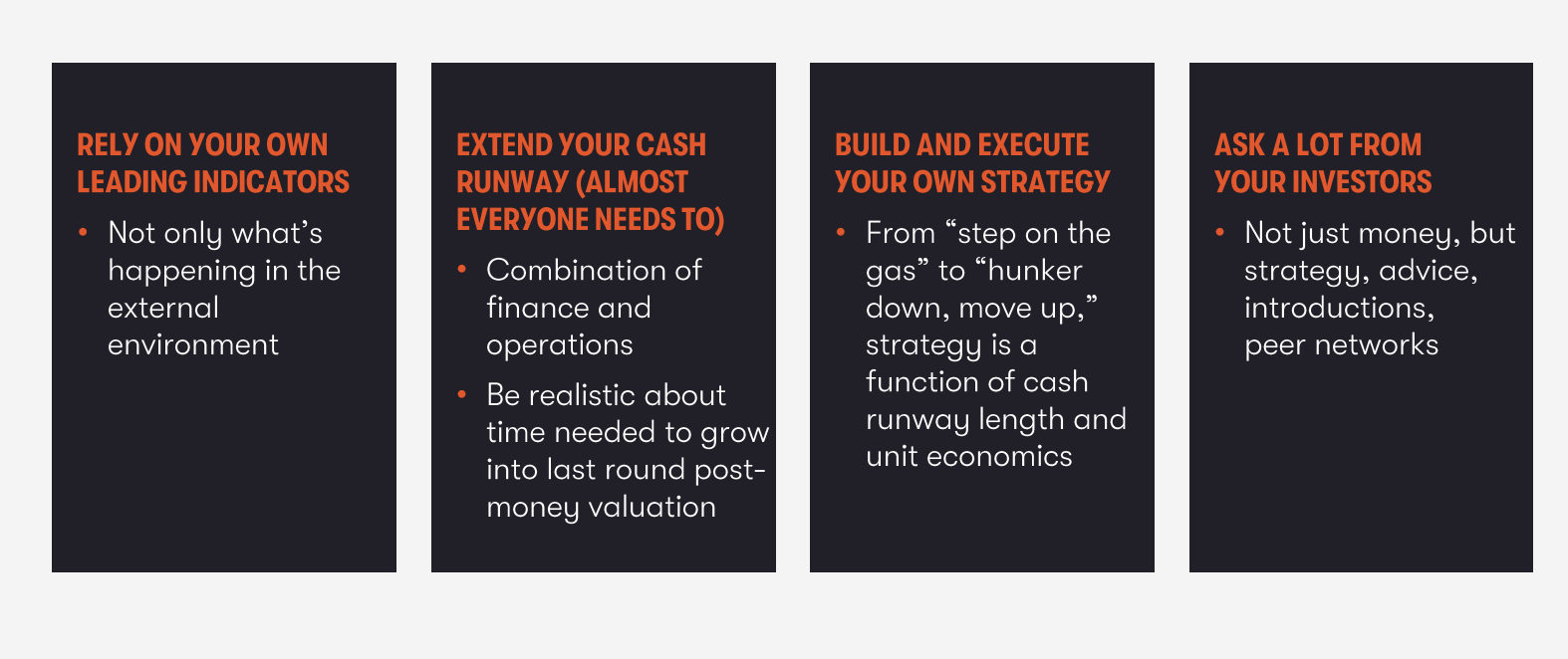

Before you make any structural or strategic changes, make sure you’re acting based on your leading indicators, and not just following the crowd. Focus on what’s happening right in front of you in your business, not what’s happening around you in the sector.

4. How should you think about growth vs. burn tradeoffs?

The question to consider here is: are you going to be able to raise money at some point on terms that you’re happy with? If the answer is yes, go and make that happen. If the answer is no, then you should likely focus on cash flow break even.

What if it’s more complex than that?

- There is, of course, a broad middle ground here.

- Sit down and discuss tradeoffs with a banker, a venture capitalist, other CEOs, and/or other CFOs. Have an open and honest conversation about where you stand today, the steps you plan to take, and how that will impact your fundraising potential. Understand both the external financing environment / potential comparable companies, as well as specific industry and company tradeoffs.

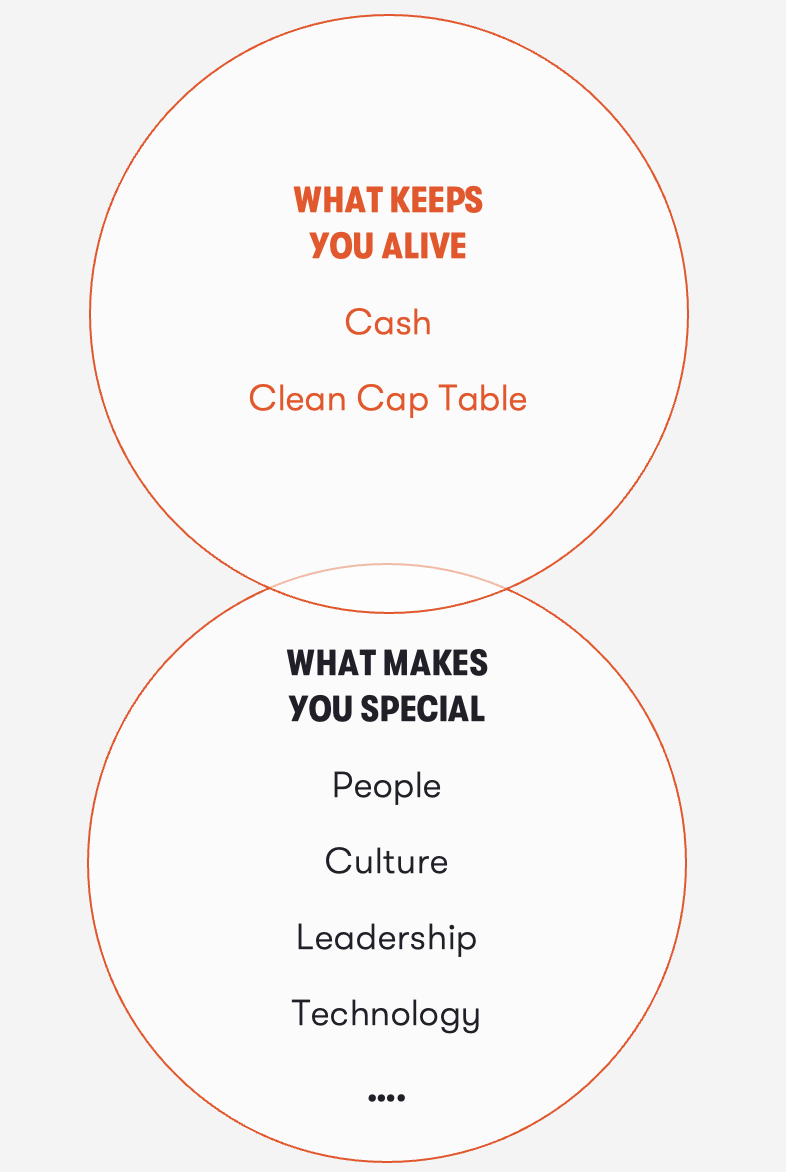

Surely there’s more to it than just the financing?

- Yes, it’s also about what makes you special. You need to distil the essence of the business to decide what truly makes you special, and be highly focused on it.

- Your team will want to know the mission that inspired them to join the company has not changed, so if you need to delay doing things, be sure to communicate clearly and openly that you’re still on track, the road just might look a little different and take a little longer.

5. What kind of support should you expect from your investors?

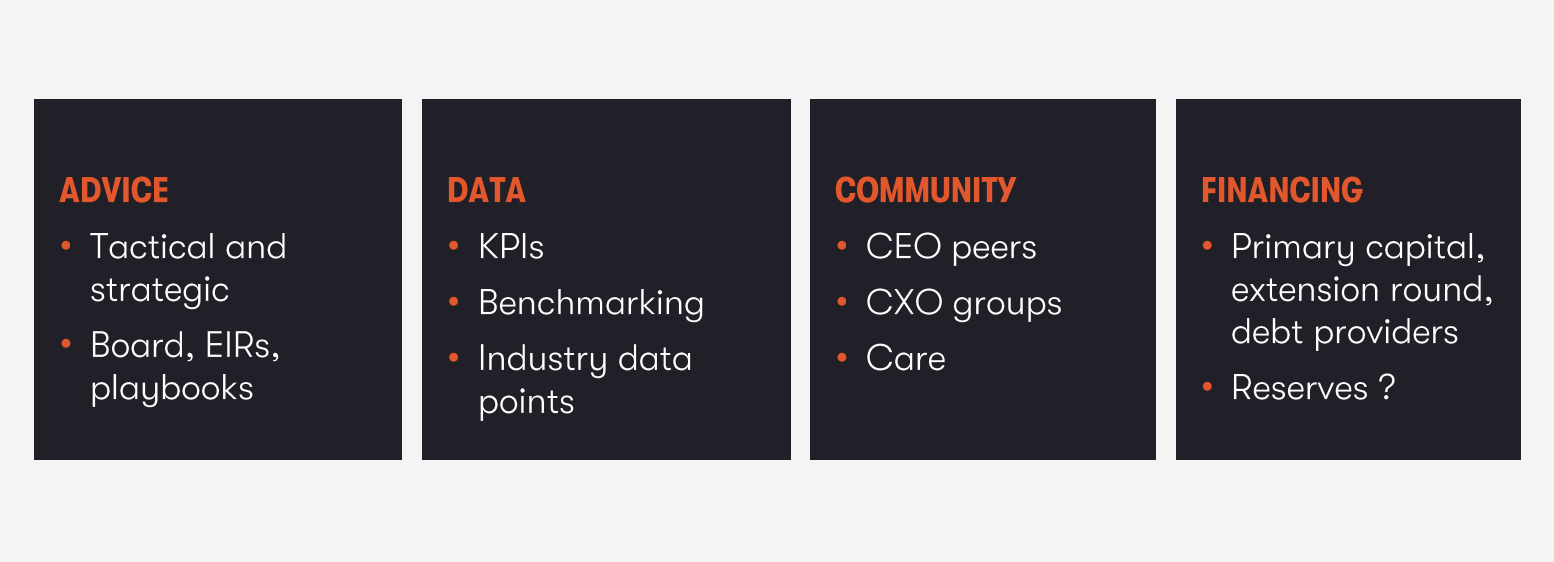

It is time to make the most of what your investor has to offer. The most important thing is to ask for specific advice – because every company, and every situation, is different.

Some of the ways investors can support you include:

Providing KPIs and Data: Investors should also have a lot of data points to share with you on your sector, to allow you to benchmark yourselves against others.

Connecting you to the community: Peers are a great resource for finding out how other businesses are responding to similar challenges, not just at CEO level but across all CXO positions.

Financing:

- Portfolio company reserves: Ask your investors what reserves they have for you.

- Extension round: They should be able to help put together an extension round or offer advice on how to structure one.

- Next raise: Your investors can give you a good idea of what other investors will be looking for when you go out to raise.

- Debt providers: They should also be prepared to give advice on debt financing.

In summary, how you choose to navigate the current economic climate will be unique to your team and company.

Whatever strategy you pursue, be sure to rely on your own leading indicators, extend cash through a combination of financing and operations, and ask a lot from your investors.