Balderton Partners, Rana Yared and Rob Moffat, explain why the sector is on the cusp of its next revolution.

Rob Moffat and Rana Yared, Partners at Balderton

The world of payments is changing rapidly. We believe we have reached a pivotal moment that will change the way we think about payments and result in many new players entering the ecosystem.

Today, companies whose raison d'etre is far from fintech find themselves needing to process payments transactions in very large quantities; we refer to this phenomenon as the “fintechization of consumer businesses.” The historical infrastructure which only supported financial institutions with payments is therefore increasingly unfit for purpose. While open banking for payments is still in its infancy, we expect to see growth in adoption when the UK introduces Variable Recurring Payments (VRP) in July. At the same time, the broader adoption of digital assets and cryptocurrencies has highlighted how non-traditional technologies can be used for traditional payments.

Managing payment complexity

Change is particularly apparent when you look at the consumer side of the market. Merchants today have no choice but to think carefully about payments. Many of them are important access points into the payments workflow. We have seen our portfolio companies building teams of 10 people or more, just to manage all the different payment methods for relatively small businesses. Larger merchants have teams of hundreds managing reconciliation, payment flows, and failbacks. While this may seem unusual, online merchants often find that the underlying business they are running is functionally a fintech.

One of our portfolio companies, smol, illustrates this trend. As an online retailer selling eco-friendly homeware products direct to consumers, smol did not set out to deliver multiple payments solutions to its clients. Nonetheless, the needs of its clients push the company to offer and maintain a range of checkout and payment systems in multiple currencies and methods.

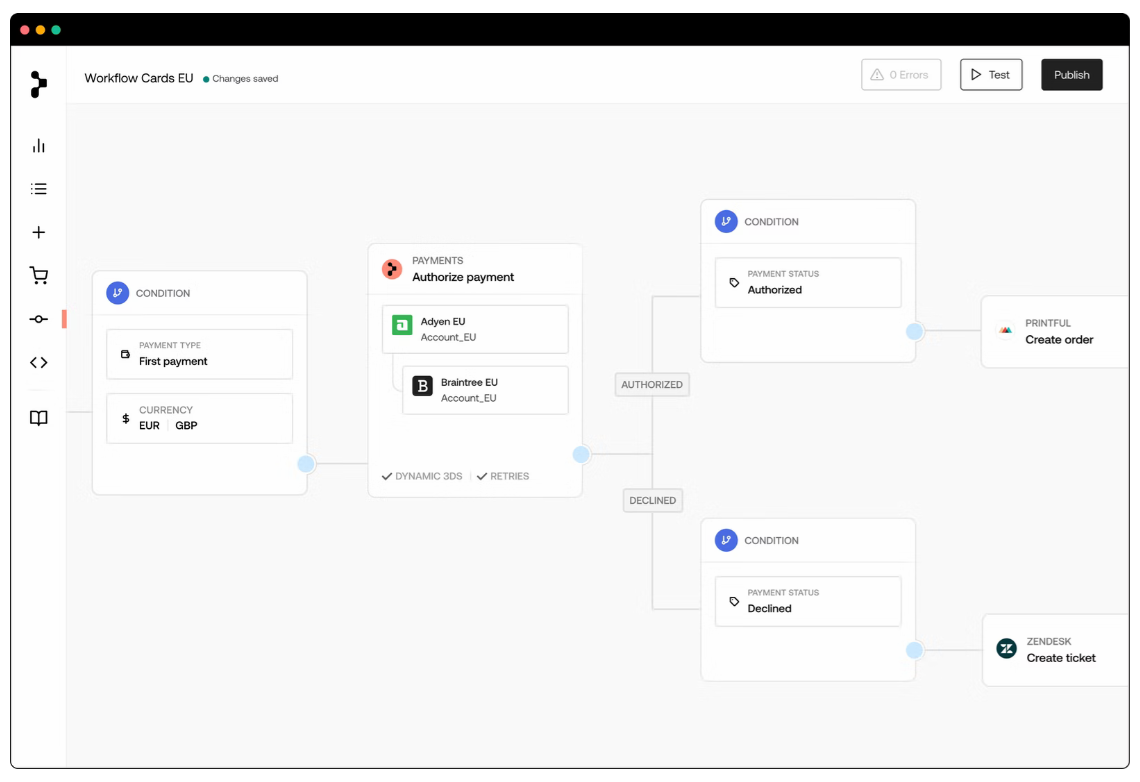

There is, therefore, an increasing need for out-of-the box solutions that reduce complexity. Primer, for example, offers a no-code solution that gives merchants the ability to build, connect and control their entire payments workflow and quickly connect to Stripe, Klarna, GoCardless and other providers. This allows companies like smol to focus on core business, without requiring a large team of payment specialists.