Where to start with ESG

Understanding the scope of ESG: The SFG framework Copy link

The scope of ESG is vast, fluid and daunting. Navigating this complex landscape and lexicon can be overwhelming for any start-up - no matter where you are on your ESG journey. To help organise your thinking, we’ve identified ten key focus areas - known as our Sustainable Future Goals - as a blueprint for what it means to grow as a sustainable tech start-up in Europe.

Inspired by the UN’s Sustainable Development Goals, but designed specifically with the world of European venture and start-ups in mind, we developed our Sustainable Futures Goals as a positive agenda for change. We believe the ten goals capture the dimensions and principles of environmental sustainability, social responsibility, and good governance and trust that should underpin the workings of any organisation wanting to have a lasting future in Europe and worldwide. They are:

Review our Sustainable Future Goals Framework.

Prioritisation Copy link

Not all SFG themes, however, are equal. The relative importance and criticality of each theme will depend on your industry, products and business model, geography and growth stage. As a start-up, you have plenty to do already. And sustainability can be a vast field. Prioritisation is therefore key to ensure that some progress is made, and that this progress is value adding.

The most successful start-up ESG approaches are informed by materiality. Copy link

In the context of sustainability, materiality means focus on the ESG topics that matter the most to your business. To identify these, you need to combine two complementary lenses (also known as “double materiality”):

- What ESG topics are most likely to impact financial performance. This could be internal (e.g. diverse talent; data privacy management; energy bills) or external (e.g. social unrest; consumer sentiment; extreme temperatures) social and environmental trends.

- What ESG topics are most impacted by the organisation. This focuses on how the business impacts the world it operates in, be it people or planet, and the responsibility that comes with it. Indirectly these could have an impact on financial performance as poor management/ aggravation of negative impact can lead to reputational damage and value destruction, while amplification of positive impacts could create additional value.

These material ESG topics should form the basis of your ESG approach. We revisit this later on in our how to operationalise section.

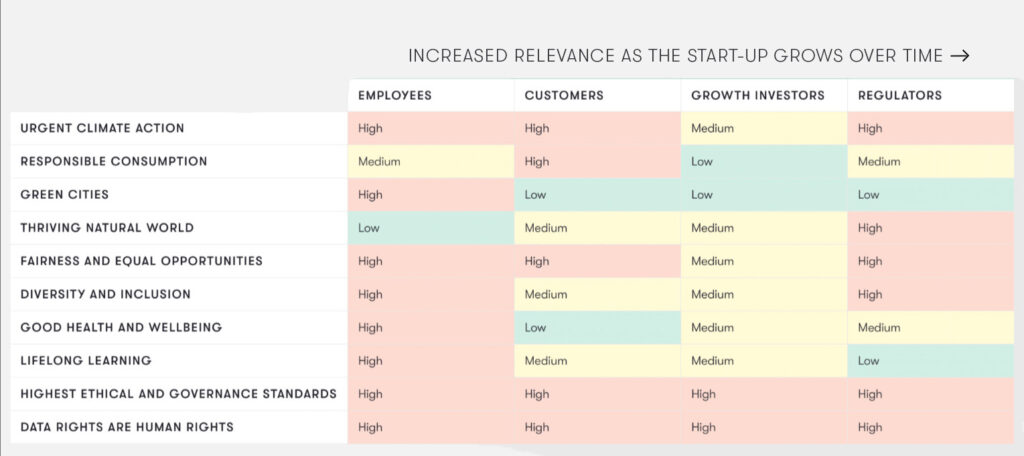

Taking a stakeholder lens can help prioritise effort and focus. Copy link

As a starting point, alongside the business values and convictions, we believe that taking a stakeholder lens can help prioritise effort and focus. Understanding what matters to and what will be expected the most from different stakeholder groups can help early-stage companies (1) understand the relevance of each of the ten SFGs and (2) help prioritise what is essential to get right now vs. what can wait a little later, bearing in mind that laying good foundations now will pay dividends later.

We have created this stakeholder matrix to help you decide where to start and what to expect as you scale. To be relevant to a maximum of businesses, it focuses on internal principles and practices only - irrespective of what the venture is (for example, of course green cities will be of the highest importance to customers of e-mobility solutions. But a business’ internal commitments and initiatives promoting green cities through employee green commuting will be more anecdotal, in the nice to have category).

The table is our perspective and is subject to variability specific to your product, business model, industry and jurisdiction.

In the following sections, we zoom in on each of the ten thematic areas, providing some framing, suggestions and inspiration on:

- Why it is important;

- Where to start (organised into checklists for Pre-Seed/Seed, Series A, and Series B+);

- What data to start collecting (for internal MI or external reporting);

- Useful resources and further reading; and

- Examples and testimonials from the Balderton portfolio and beyond.