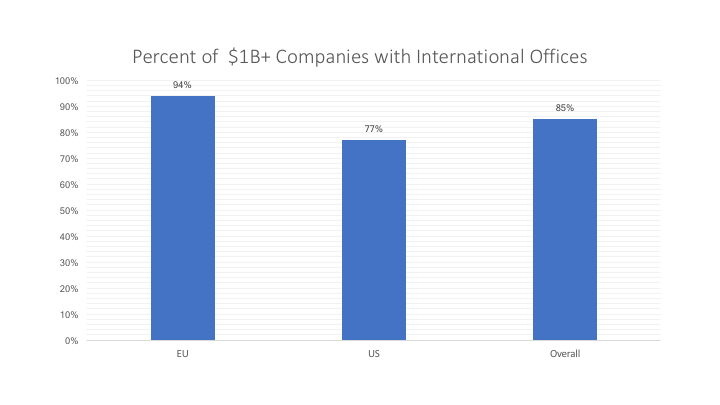

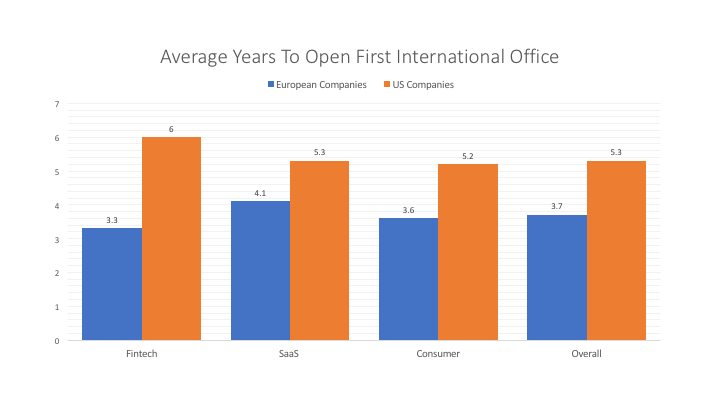

In this article, we take a look at 94 European and US venture-backed companies worth over a billion dollars to see where, and when, they expanded internationally.

As a data-driven investment firm, we have now turned to the numbers to understand how the most successful European and US companies are building global businesses.

The articles in this Internationalisation playbook:

Part 1: When should your fast-growth European startup expand into international markets?

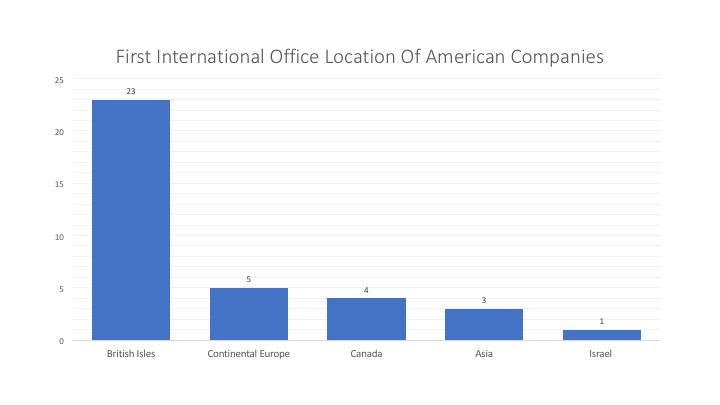

Part 2: Where should your fast-growth European startup expand internationally?

Part 3: We take a look at 94 European and US venture-backed companies worth over a billion dollars to see where, and when, they expanded internationally. (This article.)

Part 4: Internationalisation: How to budget

Part 5: Your geo-expansion playbook, from guest author Pranav Sood of GoCardless

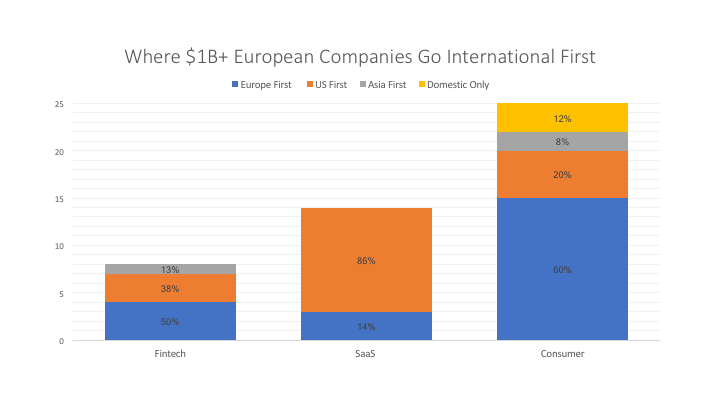

The sequential approach to internationalisation takes too long and by the time the company is ready to cross the Atlantic, a competitor in the US has popped up, raised money and got a head start.

The sequential approach to internationalisation takes too long and by the time the company is ready to cross the Atlantic, a competitor in the US has popped up, raised money and got a head start.